Power Purchase Agreements (PPAs) for solar PV systems and wind turbines

Short & Simple

Flexible PPAs tailored to individual requirements

Within the next couple of years, many operators in Germany will be faced with the question whether or not a profitable continued operation is possible since numerous parks will no longer be eligible for state subsidies provided under the German Renewable Energy Sources Act (Erneuerbare-Energien-Gesetz (EEG)). Together with selected off takers, energy consult has therefore developed PPAs that are designed to meet the flexibility requirements for the operation of power systems that are no longer subsidised.

This ensures the continued operation of post-subsidy systems for several more years. Should repowering be an option, this period can be used as a transitional measure to obtain all necessary permits.

Due to increased market prices, new plants and plants that still benefit from fixed state-guaranteed feed-in tariffs can also benefit from PPAs. We offer these parks the opportunity to secure potential additional revenues for the coming quarters or years.

Through the customised design of the PPAs, you gain planning security for a profitable (continued) operation of your wind and PV power plants.

Our Power Purchase Agreements (PPAs)

We design our PPAs flexibly in consultation with the plant operators. These are some of the key features:

- No obligation to supply a minimum quantity

- Termination of the agreement without obligation to pay damages when using repowering options

- No liability for damages in case of total failure of a plant

- No additional securities in the form of bank guarantees

- Free choice between a price setting in the future market or merchant root to market agreement Fixed power purchase prices are also paid in times of negative prices and redispatch

The hedging of plants with fixed state-guaranteed feed-in tariffs can be classified into three different types:

- Additional fixed price regulation

- Change into market or merchant root to market agreement

- Conclusion of financial hedging

For the financing of utility-scale photovoltaic projects, the conclusion of a PPA is mandatory. PPAs for solar PV projects share some distinctive features:

- Longer terms: usually more than 10 years

- Higher relevance of the off taker’s credit risk

- Long-term assessments of price and volume risks

Your advantages of working with energy consult

- Benefit from the connections and volume of the PNE Group in the electricity market through attractive conditions

- Determining the right time for a price setting and the necessary monitoring of electricity markets requires a lot of time and know-how - save yourself the time-consuming development of own skills

- You gain access to experts from, for example, the energy industry as well as energy and contract law and can thus save these costs and time of your own organisation

- You remain flexible with energy consult's standardised agreements (including the option of termination due to major damage and in case of repowering)

- Nils KompeHead of Energy Supply Services

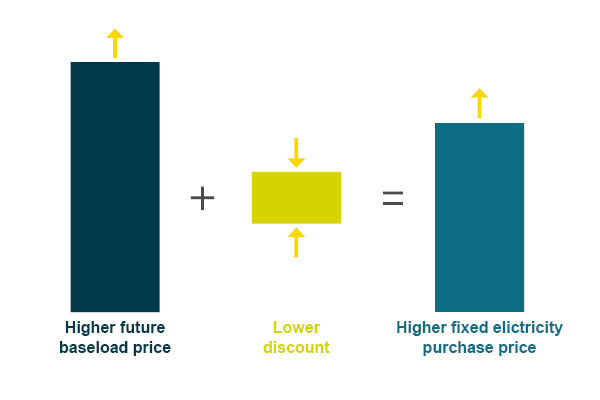

What is the composition of the fixed electricity purchase price?

To receive remuneration for the energy generated from renewable energy sources at a fixed price, it is necessary to conclude a power purchase agreement with an off taker. The off taker sells the energy generated in the future and assumes the risk of price and production fluctuations. In addition, plant operators can generate income from the sale of Guarantees of Origin (GoO). A Guarantee of Origin is a document that certifies electricity originated from renewable sources and is billed per megawatt hour of electricity generated. The sale of this certificate is usually part of the PPA.

The fixed power purchase price is the so called “future baseload price” minus a markdown for the off taker, which covers the risk of variable feed-in and includes the remuneration for the guarantees of origin. The future baseload price is a product on the power exchange for the constant supply of electricity over a defined period in the future. To be able to compare offers from different off takers, it is therefore primarily the discount that should be compared, as the future baseload price is variable over time.

energy consult as intermediary between plant operator and energy off taker

Energy consult combines two areas of expertise in the complex fields of plant operation and the electricity market and thus supports the conclusion of PPAs as an "intermediary" between plant operators and energy off takers. After conclusion of the agreement, energy consult also advises the operator on the timing of price fixing in the future market to achieve the highest possible fixed electricity purchase price for the operator.

As a plant operator, you can also count on the expertise of energy consult during operation of your PV systems and wind turbines and contact us with any questions you may have about power purchase.